Yes, life is quantum. Generalization, generalization… What else can be generalized? Economics, of course. Traditionally, economics is about money. Guess what? Money is doing very well.

But economics ought to be about workers. Then workers will do as well as money is doing now.

A famous fact is that Central Banks are “Lenders of Last Resort”. And who are the banks lending to? The Rich. How come one never talks about the employer of last resort?

Another thing that can be generalized, is the Great Depression. I was totally right to call the present economic degeneracy the “Greater Depression”

Yes, worse than in the so-called “Great Depression”. That’s why Putin is angry. (All powerful and angry: a bad cocktail.)

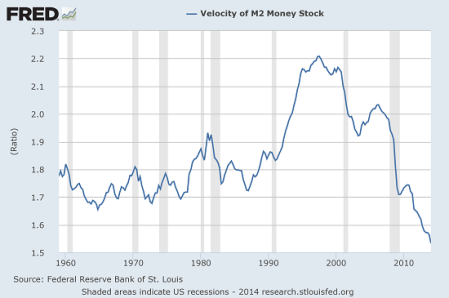

M2 is the total quantity of money in people’s hands, or their saving accounts. The M2 Velocity, measure of economic activity, is collapsing, lower than ever seen before (I will produce a full graph over a century another time; I had a problem with my Federal Reserve account). M2 velocity predicts deflation. Samuelson discovered M2 velocity varied:

“In terms of the quantity theory of money, we may say that the velocity of circulation of money does not remain constant. “You can lead a horse to water, but you can’t make him drink.” You can force money on the system in exchange for government bonds, its close money substitute; but you can’t make the money circulate against new goods and new jobs.”

In other words, Quantitative Easing is not work (take this, Krugman!)

In the giant Inca empire, there was plenty of work, and the main employer was the government. (Things went well, until smallpox showed up, courtesy, and advance guard, of the Castilians…)

When Darius founded his giant empire, his government was the employer of first resort, building a giant road system. Later Darius switched to other forms of economic governance, including free market capitalism. The Achaemenid Empire was such a stunning success, not doubt because of the extremely activist stance of its economic governance. (Athens reciprocated in kind, with just as active private-public military industrial complex.)

Here is Paul Krugman in “Rock Bottom Economics. The Inflation and Rising Interest Rates That Never Showed Up”:

“Six years ago the Federal Reserve hit rock bottom. It had been cutting the federal funds rate, the interest rate it uses to steer the economy, more or less frantically in an unsuccessful attempt to get ahead of the recession and financial crisis. But it eventually reached the point where it could cut no more, because interest rates can’t go below zero. On Dec. 16, 2008, the Fed set its interest target between 0 and 0.25 percent, where it remains to this day.

The fact that we’ve spent six years at the so-called zero lower bound is amazing and depressing. What’s even more amazing and depressing, if you ask me, is how slow our economic discourse has been to catch up with the new reality. Everything changes when the economy is at rock bottom — or, to use the term of art, in a liquidity trap (don’t ask). But for the longest time, nobody with the power to shape policy would believe it.

What do I mean by saying that everything changes? As I wrote way back when, in a rock-bottom economy “the usual rules of economic policy no longer apply: virtue becomes vice, caution is risky and prudence is folly.”

Indeed. Reason emanates from the Quantum, and what does the Quantum do, when boxed-in, with no classical way out? It tunnels out!

This is exactly why bacterial genetics can exhibit intelligent behavior (as Lamarck correctly anticipated); a changed environment changes the Quantum tunneling prospects, and can induced “directed mutagenesis”[John Cairns, Harvard U., 1988).

So intelligence ought not to be boxed in. Folly is often the best wisdom.

Economics, at this point, has been completely boxed in by the plutocrats.

Krugman again:

“Government spending doesn’t compete with private investment — it actually promotes business spending. Central bankers, who normally cultivate an image as stern inflation-fighters, need to do the exact opposite, convincing markets and investors that they will push inflation up. “Structural reform,” which usually means making it easier to cut wages, is more likely to destroy jobs than create them.

This may all sound wild and radical, but it isn’t.”

The bottom line is that there is not enough economic activity. Rather than repeating what I have said in the past, here is a new argument.

The reason interest rates are so low is that there is too much money for too little employment proposed. So money is not in demand.

If money were in demand, banks would pay for it.

So the bottom line is that work has to be created. Those who have money, the plutocrats and their agents, have no interest to create work, by investing capital, as this would make them dependent upon workers.

Instead they have increasing means, from financial derivatives to robots, to complicit central banks, and fiscal tolerance, to make money from capital without using human capital. The more they do it, the more they like it, the more vicious they get, and the more inclined they are to do it some more.

So what is the way out? Just as the government (in its role as central bank) is the lender of last resort, the government is the employer of last resort.

We are now experiencing the last resort. Thus the government needs to create employment. It can do this in two ways:

1) making it easier for business activity. Say by taking spectacular fiscal measures: as it is some corporations, typically very large pay very little taxes, why small ones are suffering from the opposite: way too much taxation. Most jobs are from the small businesses, most clout, and corruption, from the very large ones. This is a case where more democracy would lead to more economic activity, by creating a fairer market.

2) by outright paying people to work. An obvious target would be to create jobs in education and fundamental research.

Instead, our friend, the naïve, ill-advised Obama has decreased fundamental research, instead stuffing his “friends” and helpers with subsidies.

There are several promising leads with thermonuclear fusion (in part from more advanced electronics). But the government refuses to finance the research as much as it deserves (austerity for research, cornucopia for plutocrats).

Students are forced to borrow to attend ever more expensive universities. That forces them into “profitable” fields, which do not profit society at all.

The times are crying for massive investments in education, research, green infrastructure, cheap and efficient mass transportation and housing.

None of these projects can bring a quick buck. So the notion of profit is not relevant. Instead this infrastructure economy will quick-start the for-profit economy.

Is there an economy working that way somewhere? Well, yes, Switzerland. There, propped by the citizenry, the governmental economy, which is generally at the level of the canton, is very active.

Direct democracy mitigates massive corruption.

So, as Samuelson noticed, we need to go well beyond giving more money to the largest banks (Crude Men’s approach, called Quantitative Easing). We need to follow Roosevelt approach, the old synthesis of government and economy, long practiced by the most advanced civilizations, from Persia, to Greece, to Rome, to the Tang in China…

Provide people with hugely useful work. Recently the Chinese government was working on its system of grand canals. At some point, 14 centuries ago, a particular canal in that system provided three million laborers with work, all at the same time. And it is useful to this day.

The way is clear. It is the exact opposite of austerity and the rule of greedy plutocrats. Time for work, intelligence and generosity.

Patrice Ayme’

Tags: deflation, Economic Synthesis, Government Work, Great Civilizations, Krugman, M2, Money Velocity, Samuelson

November 25, 2014 at 5:20 am |

Very useful essay, PA. I was amused the other day, when chatting about present times with a close neighbour, both of us bemoaning so-called representative democracy, to hear him remark, “If we can bank online, we most certainly could vote online.”

Thought it a wise remark!

Won’t hold my breath though!

LikeLike

November 25, 2014 at 9:43 pm |

Indeed, that’s a nice, easy to swallow way to put it!

All laws ought to be voted by We The People. Even going to war.

LikeLike

November 26, 2014 at 12:49 am |

Especially going to war!

LikeLike

November 26, 2014 at 4:59 am |

Hence the interest of keeping We the People informed. Direct democracy enforces direct information.

LikeLike

November 29, 2014 at 4:23 pm |

I’m not so sure that online voting is such a good idea. Voting needs to be totally transparent; computer systems are black boxes: ‘deterministic’, yes, but the outcome can depend upon who it is who holds the keys. An open source voting system might offer a solution — but I find it hard to picture any of the problem governments of today agreeing to implement any system that doesn’t offer them the means to game it.

LikeLike

November 29, 2014 at 4:48 pm |

Good point Pendantry. But I am sure that it could be fixed. The present system, with local assessors of the various parties present, counting, can still be gamed in various ways (and it is gamed, in perhaps a majority of countries; the biggest baddest example is Russia’s dictatorship).

Please notice, though, that Direct Democracy does not require Internet Voting. The Swiss People vote every few weeks on all new laws, and do fine without computer voting.

PA

LikeLiked by 1 person

November 25, 2014 at 5:38 am |

Years ago, you have excoriated Obama for his investing the US Government in start ups owned by his friends. Do you still hold that opinion? (As you seem to)

Republicans hold that against government in politics

LikeLike

November 25, 2014 at 5:37 pm |

Yes, more coming on that soon. The poster boy is multi-billionaire Elon Musk.

LikeLike

December 20, 2014 at 11:59 pm |

[…] As I said, the state will have to be the employer of last resort, it has always been, and always will be. The free market is great, but it’s not really free; the state pays for it. […]

LikeLike