Britain is organizing an anti-corruption conference. Is that a form of British humor, or:

Should the EU Expel Britain From The European Onion?

More than 40 years ago, Great Britain’s population voted to join the European Union. Now it’s voting to see whether it wants to leave. This smacks of the tactic of obstruction through obfuscation, the story of the criminal accusing the police of being violent. From the point of view of justice and solidarity, it should. Then the European Union could apply sanctions against it for TAX FRAUD.

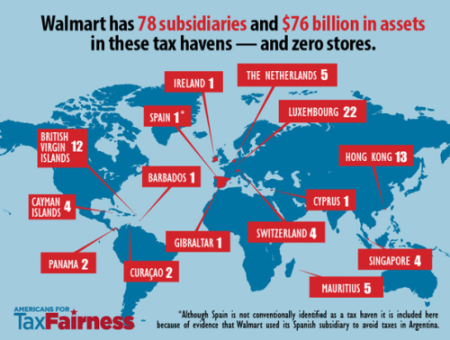

One third of tax havens of the planet are actually states which have as head of state the Queen of England. That makes the Queen of England assuredly one of the greatest head of organized crime in the history of civilization. That criminal network pervades the USA. Just contemplate this:

Anglo-Saxon Plutocrats Own The Anglo-Saxon Main Stream Media Which Wants You To Not Know That Many Of Said Plutocrats Are Just Tax Criminals (To Start With).

Let me repeat slowly. One third of the world’s tax havens in monetary volume are British: Bermuda, Cayman Islands, British Virgin Isles, Isle of Man, Channel Islands. If one evaluates the half of the world of entities made to avoid all authorities, including tax authorities, are residents of territories headed by the Queen of England.

That corruption is becoming a problem is not just my opinion. David Cameron thinks that Afghanistan and Nigeria are “fantastically corrupt”. Cameron was caught on tape boasting in front of Queen Elizabeth Cameron that “some leaders of some fantastically corrupt countries [are] coming to Britain” for his anti-corruption summit”. And he was joking with the corrupter in chief, the Queen!

Nigeria’s President Muhammadu Buhari said he did not want an apology from Cameron. Instead he pointed out that Britain could return assets stolen by officials who fled to London.

Forget Nigeria – David Cameron needs to tackle the tax havens in Britain’s own backyard

Says The Telegraph:

“Certainly Nigeria has a reputation. But the Panama Papers have shifted the focus of corruption far up the supply chain, to the people who make corruption possible – and those people are often rather closer to home.

The UK, to its credit, has been at the forefront of the movement to make the world more financially transparent. The 2009 G20 Summit, hosted by Gordon Brown in London, created the first blacklist of tax havens that were holding out against sharing information on bank accounts with other countries’ tax authorities.

Under David Cameron’s leadership, the UK also became the first country in the world to require companies to be fully transparent about the people who own and control them. This is the key step towards stopping people squirreling money away behind fake companies they secretly own, out of the reach of the taxman and other authorities.

Other countries have since followed suit, and soon all countries that are part of the EU will have to collect information on who ultimately owns and controls companies and make that available to anyone who can demonstrate a legitimate interest. So we should be proud of our leadership here.

But careful readers of the Panama Papers will notice an important fact that should have given Cameron pause for thought before he made his comments to the Queen. More than half of the companies named in law firm Mossack Fonseca files are incorporated in Britain’s own tax havens. In fact, a full 50 per cent of the companies are from the British Virgin Islands.

Prime Minister David Cameron knows this. He said so just a few months ago:

“Some of the British Crown Dependences and Overseas Territories are making progress […]. Others, frankly, are not moving anywhere near fast enough. […] If we want to break the business model of stealing money and hiding it in places where it can’t be seen, transparency is the answer.”

Thanks to unfair austerity, avoiding taxes – whether legally or illegally – is coming to be seen as wrong. If one wants to live in a society with decent schools and hospitals, no terrorism and an army powerful enough to not have tens of millions of refugees trying to smash through the border, all – rich and poor, small companies and giant ones – should be contributing to the public power. A recent poll for anti-corruption organisation, Global Witness, and Oxfam showed that 80 per cent of British adults agreed with the statement that “David Cameron has a moral responsibility to ensure that the UK’s Overseas Territories are as transparent as possible.”

However, PM David Cameron has whined disingenuously, for years, that “he cannot impose his wishes on independent territories.” So, instead of organizing a referendum on whether massive tax fraud can be perpetrated by the Queen of England, her dependencies, dominions and other minions, Cameron organized a referendum about whether Britain wanted to be in Europe or not. As if, after voting against Europe, it would find itself somewhere southeast of New Zealand.

There are fourteen “British Overseas Territories”. The Crown Dependencies of Jersey, Guernsey and the Isle of Man are also tax havens, under the sovereignty of the British monarch. When Britain want to exert power on the dominions, it can: Britain forced dominions to abandon the death penalty (1991), or punishments against homosexuality (2000).

Meanwhile any fantastically corrupt rogue official, thief or criminal can come to Great Britain and become a “Non Dom”, a non-domiciliated person, not taxed for at least seven years. Canada and the USA have imitated facets of this program. Some of China’s richest billionaires, anxious to be skewered by president Xi’s anti-pollution drive, have their children in Canada, driving around in cars worth hundreds of thousands of dollars.

All this to say that the “summit in London on the struggle against corruption”, May 12, 2016, is a colossal hypocrisy. And the stakes are not small. Not only is civilization is at stake, but the biosphere itself.

How did Rome fall? Rome fell in many ways: it became a tyranny, a plutocracy (all emperors were born from a small clique of families jousting for power among themselves, and exchanging the imperial throne as if was a frisbee). Rome became also anti-technological, and anti-scientific. Later it became a theocracy.

The historian Edward Gibbon was connected to the British plutocracy, so he could not accuse the plutocratic phenomenon to have caused the Fall of Rome. Instead, he accused Catholicism (as did Nietzsche). However, theocracy was the last justification tyranny found for itself. Plutocracy caused the Fall of Rome, and, over the next centuries, piled up the outrages.

So how did plutocracy blossom? By eschewing old Roman Republican law which limited absolutely the size of a family fortune. And how was that accomplished? With all the overseas dependencies and possessions Rome found itself with after the victory of Rome in the Second Punic War (final victory in 201 BCE). Those included North Africa, Spain, Macedonia, Greece… In those territories, it was not clear that Roman law had jurisdiction. The same loophole allowed slavery in the New World after 1500 CE: Frankish law had established jurisdiction outlawing slavery, all over Europe, in 655 CE. But the law could not be imposed in the New World, be it only because those who ruled there had no interest to see to it.

Recent globalization has operated in a similar fashion. This is all the more strange because American and French jurisdiction proclaim themselves as universal (France is presently judging Rwandan civil war criminals).

The explanation? Great Britain and the USA have been milking the tax haven, international corruption trick: trillions of corrupt, dark, criminal money has kept them afloat, by coming from all over the world. France has done so too, but on a much smaller scale The latter case explains why Frenchman Pierre Moscovici is showing no alacrity to punish Luxembourg.

France and Germany are the core of the European Onion. It’s high time for them to seize their responsibilities. The terrible example of Britain has led to massive tax thievery by the likes of the Netherlands and Luxembourg. High time to get tough on more than retirees, elementary school children, and the indigent.

The arsenals of democracies have become arsenals of corruption. That may give leverage over Putin, since his plutocrats put their money in Western tax havens, but it’s no way to run a civilization.

Patrice Ayme’

Tags: British Overseas Territories, Cameron, Corruption, Crown Dependencies, Fantastic Corruption, Great Britain, Rome, Tax Havens

May 12, 2016 at 12:49 am |

Nope. As you yourself showed in the past, the US is the world’s most corrupt

LikeLike

May 12, 2016 at 3:08 am |

It was a rhetorical question…

LikeLike

May 12, 2016 at 10:38 am |

Her Royal Majesty’s signature is indeed all over the place, as I discovered when perusing the Lomé Convention.

However, her actual influence on policy, as opposed to her moral authority – which in all likeliness will not survive her – is nil.

Britain’s centuries-long roll in the hay with Pluto can be safely ascribed to successive British governments AND the British people. Democracy has its rules, which you recall to justify the (mild) punitive treatment of Germany.

LikeLike

May 12, 2016 at 3:15 pm |

The joke’s kind of the British people, then; they certainly benefited greatly and broadly from the British empire, to the point it apparently very much still is part of their national myth, cf. various opinion polls over the years, the recent “internet meme” success of that map – from a book? – showing how very few countries were not “invaded” by the Brits, or, more pervasively, that notion taken as a settled truth that Brits ex-colonies are innately better than, say, French ones (cue in the tried & true “Francophone Africa is an hellhole” bit).

But, they forgot that, they the common people, not even to mention the proles and undesirables, are sub-humans like the others; a bit above, certainly, as they make for an useful mass of servants, soldiers, some of them having been bred as an excellent class of enforcers (the so-called “Scots-Irish”, the original template for the more exotic “warrior races” lackeys of the empire, who still make up IIUC the bulk of the US frontline troops as White Southerners), but still non-quantities.

Now, the British empire has gone global, has shed its “National” guise, and stands in all his for-profit, private ventures majesty (a bunch of researchers “mapped” international business through a series of “nodes” a few years back, and it turned out that most of those “nodes” controlling this globalized world were anglos, and most of that, Brit, IIRC).

And the no-longer-needed Little Englanders wonder why they are flooded by wogs (hint : because this strategy has worked wonders before, and it will work wonder closer at home again), why they are treated like the shit they are in the eyes of their Betters (hint : because they are, really), and why they are no longer a step or more above the rest, and do not even get some empire crumbs anymore (hint : because, why waste crumbs?)

Ah, well, still way better than France, that neutered, defeated, and on its way out old adversary and once sole other model.

LikeLike

May 15, 2016 at 2:44 pm |

[Sent to IanMiller blog.]

Just saw your very interesting essay today. Although I have written hundreds of pages on Dark Money, Tax Havens, Tax Evasion, Dark Liquidity, I was unaware of the New Zealand as a tax haven. I should have guess, considering the boom in property prices (which is a marker of the plutocratic cancer). So thanks!

Plutocracy has ruled Britain since the “Glorious Revolution”. Still waiting for the second shoe to drop on Non-Locality, BTW… 😉

LikeLike

May 15, 2016 at 10:05 pm |

Yep, places like the British Virgin Islands are clearly tax havens, and the law on financial matters in a few other possessions is pretty crumbly.

Second shoe dropping very soon – I do my physics posts on Monday 🙂

LikeLike

May 16, 2016 at 3:41 am |

England itself is a tax haven: “Non-Dom” don’t have to pay tax for seven years, plenty enough time to hide money in all sorts of ways. Hence the sky high real estate in London.

LikeLike