The strategy. The tactics. Everything. Since 2008, the central banks have created money. Why? Key actors of the economy lost too much money in 2008 to keep on functioning. Some of these actors: banks and “shadow banks”.

How did the central banks create money? Mostly by buying government debts from the large private banks. The banks thus made money. Who caused the 2008 crisis? The banks. Thus the very strategy used is Orwellian, and promotes a vicious circle. Upon closer inspection, the situation deep down inside is more of the same and even worse.

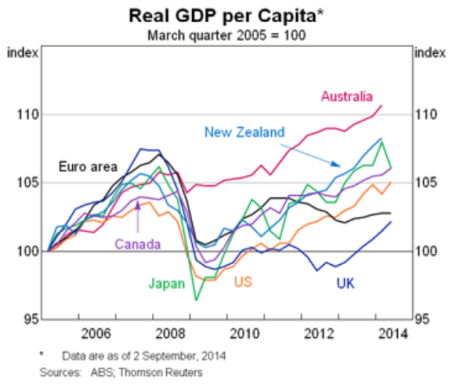

The result has been a faltering of economic growth, a creeping destitution of the 99.9% in the West, and the blossoming of colossal inequalities and corruption, worldwide:

True, banks are more regulated than in 2008 (but much less than before the Clinton presidency brought devastation to the regulation of finance!) However, a large, maybe the largest, part of the banking system is “Shadow Banking”. That’s not regulated. By fostering fiscal heavens and anonymous financial entities, Great Britain and the USA are actually expanding the “Dark Pools” of money which feed “Shadow Banking”.

So what have the banks done with the money generously given to them by central banks? Did they invest it somewhere fabulous? No. There has been no new technological, industrial, economic, social breakthrough which needed, and provided with, the opportunity of massive investment.

(There were some efforts towards “sustainable energy”, but those subsidies and regulations are dwarfed by those in favor of fossil fuels, which total 5.5 trillion dollars, according to the IMF; the key is fossil fuels do not require much new investment, including in research, development and education as new energy sources would.)

No new nuclear program was instituted (say replacing all old reactors with better and safer ones), no thermonuclear powers plants (although a crash program would have probably produce those already), no massive space program (comparable to Apollo in the 1960s).

Even biomedical innovation, hence investment, has petered down (research has been smothered down by marketing, regulations, and cut-throat academia producing poor research).

But, mostly, there has been no new construction program in housing and physical infrastructure. Oh, there is a massive need: the dearth of housing is why real estate is getting out of reach of the middle class, in the top cities, worldwide. (Moreover one can now make positive energy buildings, which produce energy.)

And don’t forget public education has been let go to waste, in the leading countries (with few exceptions: Switzerland, Canada…) It is as if the leadership in the West was afraid that We The People would get knowledgeable and smart.

So where did the money the banks were given by the central banks go? To hedge funds and the like. To the industry of HOT MONEY. One day they buy this, the following week, they sell it, making money, both ways (thanks to financial derivatives). The money created by the banks (which are better regulated, as I said), at this point, once given to financial manipulators, escapes regulation (that’s the whole idea).

“Leaders” know about this. But they obviously intent to keep on getting money from shadow financiers. An example: Obama did not try to tax “carried interest” by hedge funds (although Donald Trump proposes to do so!)

The leading states (USA, UK, EU, China, Japan, etc.) believed that to provide money (“liquidity”) would relaunch the economy. Absent this, massive devaluations would help. Thus Japan devalued by 50%, undercutting South Korea and China severely.

Meanwhile the IMF has allowed these competitive devaluations, following the advice of economists such as Friedman, Krugman. However, this is tickling the tail of the worst devil. War. Economic war is the first step to all-out war, indeed. Competitive devaluations are a form of war.

And what’s the main mission of the IMF? Preventing economic war between the states. This is why the IMF has been created in 1945: “The International Monetary Fund (IMF) is an organization of 188 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world.”

Thus the IMF is failing to do its main job. Notice that many American economists, from Friedman to Krugman, in their anti-European frenzy, have pleaded FOR the economic war of (European!) state against (European!) state, thanks to competitive devaluations.

Notice too that Abenomics, the devaluation of Japan, has not had much of a dent: Japan is still mired in stagnation, no doubt still afflicted by its main problem, the collapse of its population (a problem many developed countries have, especially in Europe; the USA and UK have escaped demographic collapse, mostly through massive immigration).

The world economic strategy reflects the mood of the times: the so-called “free market” is all the thinking and activity we need since Ronald Reagan. That’s in contradiction with policies followed by Colbert, Henri IV and Sully, or even emperors Diocletian and Darius. (Darius reigned over Persia 25 centuries ago.) They, like Julius Caesar, thought that the economy had to be governed by the state.

Will China try a massive devaluation, a la Abe in Japan?

Since 2008, the governments, mostly in the West, have been cowardly. The USA suffers from massive inequalities (and no, Mr. Obama, the situation is no as good as eight years ago), the European Union suffers from too much regulations (including at the level of services, where the European UNION has not been implemented), China is a dictatorship which became richer by exploiting workers relentlessly, etc.

Those competitive devaluations and lots of money sloshing around have been addictive: central banks engage in them, to give the states space, and the states, momentarily relieved, put off necessary reforms.

Inequalities suck up “liquidity” (so power and means) from average people, while putting huge amounts of money, and power, under the control of a few hands. And this money is invested in liquid investments, instead of serious things such as massive, affordable, state of the art housing and cities. Thus this money slosh around the world, like the waves of a tsunami, devastating all it touches (example: Greece, Spain, Portugal, Ireland, Iceland, etc.).

The reason the crisis goes on is the confusion between symptoms and disease. That the main actors in power have interest not to understand the nature of the crisis explains why understanding has not been fostered. Thus very few economists have seen it, let alone politicians. (From Obama down to Nancy Pelosi, Krugman, and countless “Republicans”, but also French Socialists, EC bureaucrats, USA universities professors, most actors of influence have interest to sound as intelligent as cows watching a train pass.)

How did the world come out of the slump of the 1920s to 1940s? Through reconstruction in the “30 glorious years” after 1945. Reconstruction from total war. Something to think of. One thing: many countries are on the verge of implosion. One culprit? The obvious world devaluation blatant in the collapse of the price of oil.

What is the way out of the world socio-economic crisis? The same way as it was done after 1945. Massive social, educative, health and construction programs in the West, building a useful economy, by taxing those who create the inequalities, and grab all the economy, and opportunities to themselves.

Patrice Ayme’