Q & A ON FINANCE.

Abstract: The financial crisis spreading in Europe is not intrinsic to Europe, the European Union, or the euro. The crisis has to do with sponsoring the wealthiest.

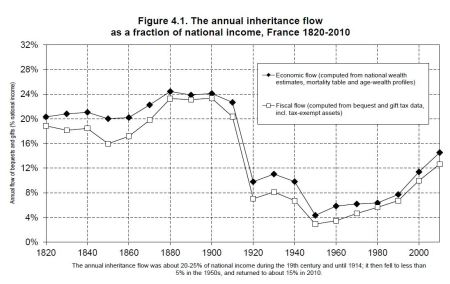

For purely mathematical reasons, the properties of the exponential function, the wealthiest always had to be taxed more. This has been known for 12,000 years, but forgotten thanks to Milton Friedman and associated gnomes.

For the last thirty years, instead of taxing the rich more, treacherous politicians have forced their countries to do the EXACT OPPOSITE. Politicians forced nations to borrow from the wealthiest, enriching the latter with the interest paid to them.

In other words, the taxing of the rich, which is necessary for a sustainable society, has been insolently perverted into the taxing of the poor.

And this, ever more, because the wealthiest fix the interest rates. Don’t expect the obsequious servants of plutocracy known as politicians to admit this. This inverted perversion is not just unjust, but insufferable. However, here we are. Thus the situation in the EU and USA is similar to that of 1789 France: odious debt.

The masses may rise in revolt, as they ought. But they better direct their rage well, and that means getting informed by reading this essay rather than the misleading, self serving disinformation oozing from the likes of the “Financial Times”, “Economist”, “Wall Street Journal”, “New York Times” (I am subscriber to all). Here we focus on the truth, therein our profit. And the truth is a value ordered function.

***

Why is there a crisis in Europe?

It is not just in Europe. Nations have borrowed money on the market, but the rates, controlled by plutocracy, have gone up. All countries are infected. A few days ago, the Netherlands, Austria or Finland viewed themselves immune, but now they are threatened, like France. And the turn of Germany, Britain and the USA is around the corner. Headline inflation in Britain is now 5.9%. Bond Vigilantes are not going to ignore this very long.

*

Does the euro have anything to do with the financial crisis as Obama, and others, have suggested?

Obama is trying, rather pathetically, to divert blame from the failed Bush-Obama economic strategy of enriching the richest of the rich, throwing money at banks, and telling plutocrats they belong.

In reality, it’s rather the other way around: American economic weakness put the PIIGS (Portugal Ireland Italy Greece Spain) economy in great difficulty, as those countries depend upon tourism more than a country such as the USA, which is still the world’s greatest economic and industrial power.

When Obama panics about Europe he makes, unwittingly, the implicit argument that hysterical financial derivatives drive the economy of the USA. Indeed whereas quotes on the financial markets have gone nuts, the European real economy is not going belly up yet. It will, but not yet.

The latest GDP growth Spring to Summer 2011 in Germany and France are respectively .5% and .4%, or about a +2% annualized GDP growth, measured instantaneously, for the 150 million citizens duo (not adding the Benelux, as the Netherlands are faltering). By European standards, this is respectable growth. Volkswagen has never sold as many cars (it’s somewhere around 6 million), and is on its way to become the world’s largest carmaker (quality sells).

So Obama’s claim that the USA is doing poorly because of Europe is premature. The only explanation is that Obama admits that the financial operators are the ones deciding upon the state of the economy of the USA. As the financiers are worried about Europe, they decide that the USA ought to be unhappy too.

Let me repeat this slowly:

In truth the euro has nothing to do with this European debt crisis, which was caused by banks making imprudent loans, and by highly leveraged conniving speculators playing the violin of sovereign debt.

*

Why is the financial crisis getting worse by the day?

Nations are rolling over their debt constantly. Using new debt to pay old interest. So the debt is consistently recomputed at variable interest rates.

The arrangement has been highly profitable to the plutocracy, allowing it, among other things, to organize a worldwide real estate bubble which peaked in London, the place where the worst financial manipulations endured.

Paying debt with augmenting interest was the main mechanism which caused the subprime disaster with the ARMs (Adjustable rate Mortgages). The worst ARMs are now unlawful in the USA. But not so with nations. However the ARMs used against nations right now are the artifacts of obvious conspiracies, and they ought to be made unlawful by the same legal reasoning which outlawed ARMs in the USA, instead of bending over backwards to please the loan sharks (as is done with present “rescue” packages).

*

Is that why the Greek debt is supposed to go from 120% of GDP to 192% during the next 12 months?

Yes. Fully austerity on, the debt explodes! It was 120% of Greek GDP 3 months ago, now it’s 143%! Only plutocrats and their obsequious servants find that this is OK. Interest charged to Greece have skyrocketed, thus so did the Greek debt. Same with Italy too. Italy has no primary deficit and most of the Italian debt is rolled from decades ago. Italy has to roll 350 billion of debt in the next year.

*

Wait, I am confused! Why would nations borrow money? Can’t they just raise taxes?

Of course, they can. And they long have. But, in the last thirty years, nations decreased taxes on the wealthy. While putting the plebs to sleep with welfare programs. The loss of the income from taxing the rich was compensated by borrowing money on the market of money. The main actors of the money markets are the wealthy.

Thus, instead of taxing the wealthy, nations are now borrowing from the wealthy, and enriching them with interest. It is a double win-win for the wealthy. Moreover, for mathematical stability, the taxation on the rich has to be so large that wealth cannot increase exponentially. Thus cancelling taxes on the rich as Bush and Obama did had two dreadful effects:

1) it made the rich exponentially richer, thus powerful and capable to sawy people through propaganda. Thus what I say here is not said by Krugman, or the Main Stream Media, and thus not by parrot bloggers.

2) It forced states to borrow much more. Hence Obama borrowed 12% of the GDP of the USA last year. The interest 0n that debt goes straight to the wealthiest. It’s the same throughout the West. One third of the total French national debt is due to decreasing the tax on the rich in the last ten years.

*

Market of money? Money market? Is money for sale on a market? Why would you buy money with money?

Individual and organizations find themselves sometimes with money that they cannot spend. So they lend it if one can interest them in doing so. Except if motivated by love or charity, that means they want more money back than they lent to start with.

*

Why can’t they be loving and charitable?

This is what the old Jewish religion and its outgrowth, the Muslim Sharia, seek to impose. Actually the Christians, when they had more clout than now had also forbidden to lend against monetary interest. But the interdiction applied only within each religion, so they came to depend upon each other, love and hate each other, as indispensable partners in crime.

*

Why should not the Sharia be imposed? No more borrowing, no more problem!

It is a question of economic efficiency: if actor A has plenty of money, but no use for it, whereas actor B has a need for it, and society too, then why not allow A to lend to B? If one does so, one transfers the power to employ people from A to B. A has no work, but B does, and now it can pay those it employs with the money it borrowed. So two things happen:

1) More people get employed.

2) More things get done.

This is why lending money against interest is superior. And one of the reasons why the West took off economically, while the regions dominated by the Islamist superstition stayed economically stagnant.

By the way, this is indicative of an important effect that those who evalue civilizations generally neglect. The reason why Catholics could lend to Catholics in Middle Age Italy or France is that influential Catholic leaders such as the king of France (the biggest fish around), or the leaders of the Italian republics did not give a hoot about fundamentalist Christian doctrine.

So, during the Middle Ages, Christianism was not the leading ideology of Europe anymore. It was just a facade. The political-fascist prominence of the Inquisition later masked that fact to simplistic historians. Throwing superstition in the heap of history was necesseray to Europe’s ascendency. (Cynics will point out that early Franks were not very Christian, either… Christian philosophers is more like it.)

*

Have states always borrowed on the money markets?

No. This is a recent phenomenon. Although Italian republics in the Middle Ages borrowed from bankers to pay their armies, there were not really money markets at the time, with many potential lenders. At some point Florence defaulted. Later, Francois I and Charles V, both born in northern France, fought each other in an enormous war financed by Italian and German bankers respectively.

*

Why are European states borrowing on the money market?

Two reasons. 1) after a long socialist lull after the Great Depression and WWII, plutocracy counterattacked electing Thatcher and Reagan, and making the gnomic Milton Friedman the guru of the new age. The Nobel prize in economics was then given to another 13 economists of the same persuasion.

Also the message was sent by the entire academic and propaganda machine in the Anglo-Saxon world that the Anglo-Saxon, so called liberal, highly leveraged, economic model was optimal. As I explained, the argument is worthless: it is as if arguing that a criminal who stole a lot of people by killing them, and has not been caught yet, has been a remarkable success.

Enthralled leaders, worldwide, decided that as long as money could be made from an activity, it was good, and if not, that activity was bad, and it should go away. That was excellent for those that corruption tempted. So Clinton, Major and Blair made personally giant amounts of money after their plutocratic serving tenures, but could persuade themselves that it was good because it was profit motivated, the absolute good. So corruption became an absolute good. All over.

A consequence: American education and health care are getting ever more expensive and worse, except in particular cases were profits can still be made, such as in publicly financed private universities.

*

Please do not be sarcastic, it hinders your message.

I am not sarcastic, but ferociously veracious. Great private universities in the USA are not just privately financed, but also publicly financed. However, mostly indirectly so. Same for the banks, Same for the military-industrial complex. Same for the drug and HMO industry. Same for the largest corporations. Same for the hyper wealthy. Socialism for the wealthy, taxes for the rest.

*

What was the persuasion of Friedman and his cohorts?

That greed is all you need. Friedman and his aliases and allies believed that, given enough greed, even a bloody dictatorship like that of Pinochet in Chili, could do no wrong. Friedman went to Chili, and preached that message at the catholic University. In truth those buffoons were just agents, paid and promoted by the plutocracy, the hyper wealthy owners of the USA, who had to suffer through the GI Bill and Johnson’s “Great Society”.

*

Why do you use an offensive term such as “buffoons” to discredit a pillar of society such as Mr. Milton Friedman?

I met Friedman. I will reserve my full opinion of him for a more opinioned piece. Let’s just say that his personal experience led him to believe that pain was man’s best friend. Having made greed the main, if not the sole economic motivation, has been a disaster. It pushed away other, more valuable motivations, and, because it was an all together unreasonable opinion which was made into the ultimate reason, it made all of society more irrational.

*

What was the other reason that pushed European states to adopt financing on the money market?

French socialists have a lot to do with it. After rejecting the Anglo-Saxon model in 1980, they were forced to embrace it again, and did so with great vengeance. Under Prime Minister Pierre Bérégovoy, a simple soul, the discovery was made that France, with her AAA rating, could borrow very cheaply from the money markets. It was a easier way to find funds than by raising taxes. The reasoning was extended all over the European Union during the Stage Two of the European Monetary Union before the creation of the euro on January 1, 1999.

Bérégovoy committed suicide, or was suicided, shortly after (in connection with various financial scandals: allegations against him, and the Triangle Affair).

*

So there were two surrender of sovereignty by European states, one to the European Central Bank, the ECB, and one to money markets?

Yes, and they are generally conflated by the ignorant or the biased. Paul Krugman affects to believe that the surrender of sovereignty was to Germany. But that is simply not the case. There was a surrender of short term interest to the ECB, and one of long term interest to the actors of the private debt markets.

Actors in the debt markets such as the late Lehman Brothers. Lehman Brothers was a “Designated Market Maker” of the market of USA government debt.

In other words, Europe decided to borrow freely from the coolest, wealthiest gangsters in the world. Although Lehman failed, because of gross mismanagement, if not organized crime, dragging the debt markets with it, its three highest officers, including its CEO, Fuld, walked away with 5 billion dollars between themselves. According to Friedman and those who, like Obama, read the Financial Times too much, and too exclusively, that was just cool. However their actions arguably led to the loss of thousands of billions of dollars and euros to the public. And now an economy where the main missions of the states are not sustained.

*

So what is the problem exactly?

To maximize the money they have at their disposal, nations have learned to borrow, with impunity, as much as the hyper wealthy was willing to lend them. In particular, nations borrow money to pay the interest of the previous debt. One minute of the most basic differential equation analysis shows that the process is exponential.

Indeed the debt augments proportionally to the interest on the debt. Hence the debt is a function whose derivative is a fraction X of itself, the exact definition of the exponential.

*

What about inflation?

Right, Inflation has to be taken into account. If the interest on the debt is less than inflation, the fraction X is negative, so the debt decreases exponentially. However, the Fed and the ECB have been targeting 2% inflation. Thus the interest rate X on German debt interest payment on the ten year obligations, today at 1.81% is just in balance. But France is another story: X has reached nearly 4%. And Spain and Italy are above 6%. Greece is around 30%. That means that Greek debt will more than double in 30 months. Thus knocking off half of Greek sovereign debt now will bring just as much sovereign debt in 30 months. Cut half the heads of the plutocratic hydra, and they grow back within years, or maybe months.

*

Why is that not happening in the USA?

Well, it happened in the past. The bad actors behind that were called the “Bond Vigilantes”. Paul Krugman sang on all rooftops that they were invisible, inexistent, a figment of the past. He sang that way, although some interest rates in Greece had already reached 100%. It is baffling.

So what about the USA? Well, it has not happened yet. And there is a very good reason for that: the speculators are pouncing on the smaller and weaker countries first. An avalanche can start small, and grow enormous.

*

Who are the speculators?

Banks, hedge funds, etc. They use quasi infinite leverage. Corzine’s hedge fund just collapsed by doing something wrong while manipulating European debt. He had for 100 billion of investment, nominally, backed up by only one billion of capital.

*

Why should not that be legal?

For two reasons: 1) it allows to manipulate markets of genuine investors investing genuine money. Corzine did not have 100 billions. He just claimed he had. As it made him an enormous property owner, his buying and selling could move markets in direction he, or his accomplices, found profitable. One such technique is “Painting The Market” (a generalization of painting the tape). Although a few of these techniques are unlawful in the stock market, most are not, because regulators, who are supposed to have no teeth, plead ignorance.

2) there is no difference between being rich, and claiming to be rich and being believed by the Most Serious People.

If I claimed I had 100 billions, and people, companies, countries, did as if I did, I would be instantaneously rich, especially if dealing with another 10,000 gangsters claiming the same. One can actually do some pretty telling math. Plutocrats claim to have 600 trillion dollars in derivatives. Say each of them claims to have 100 billion that he truly does not have. So, with 6,000 such gangsters, you cover the derivative market. About two third of it consist in derivatives related to the bond market (CDSs, Credit Default Swaps).

Thus, a conspiracy of gangsters are allowed to roam the planet, and are treated as if they had 12 times the entire planet’s wealth among themselves. A consequence: they called themselves the “markets”, and they are believed, and they can do whatever they want. If they say something, it goes. The end result: a band of greedy conspirators has hijacked civilization.

*

OK, so what do you propose?

I propose changes at several levels. First at the European level, European institutions ought to be erected immediately to endow the European Union with the same powers as the USA in monetary and fiscal matters. Some of these powers ought to become effective in a matter of weeks. For example to make the ECB the lender of last resort, and give the ECB an explicit mandate to buy as many bonds as needed to keep sovereign yields below 6%, as it has done a bit, but not enough.

*

Hysterical Euroskeptics claim that plotters want a European “superstate”

As it is, we have a world superstate already: it’s the world plutocracy. A few deciders in New York and London, the two main pirates’ dens, believe things are for the best, as their cities live pretty well from it. So it is that part of Somalia lives pretty well from the pirates’ trade. But that impression cannot be shared by the rest of the planet, including those who, in developing countries, enjoy subjugation to the sub-dictators of the plutocracy.

What Euro haters are saying is that they want to stay with the present plutocratic superstate.

*

The fact remains that you suggest Europeans change once more the European constitution.

Yes, and that means changing their own too, as usual. It has been done many times in the last sixty-three years, as far as France and Germany are concerned, so it will be more of the same. There are provisions in the last European constitution to make some tweaks immediately, and actually it is part of what the ECB has been doing with its modest bond buying.

*

Philosophically, is not the rise of a European superpower worrisome? It worries some Brits.

Nationalist fanatics of the existing superpowers on the wane cannot be pleased by the rise of Europe. This means people entangled with the USA superpower, and the faltering Russia. That means poodles of the established New York-London financial order, such as Krugman and Summers (collaborators of reagan), or anybody having anything to do with the City of London.

Paul Krugman was just saying that New York was the greatest city in the world. That gave an inkling of his true heart: New York, right or wrong. Thus, Wall Street, right or wrong. Because New York would be just a shadow of its former self without wall street and its worldwide manipulations. I mean, it’s not the Silicon Valley. Of course, new York makes Krugman rich and influential. But that explains why he hates the euro so much (OK, now Krugman claims he wants to save it, and in a parallel development, Larry Summers is all out for an enormous stimulus!)

Said Brits worried by the rise of European superpower are often vested in the activities of Londonistan. London has tremendously profited from financial profiteering. The old British canard has been that Britain would not tolerate the rise in Europe of a power as great as the British empire. As I explained in The Anglo-Saxon Economic Model, that worked well for centuries, but the British empire is now the European Union, not the Commonwealth.

Super powers such as China, India, and Brazil, are much more sympathetic to Europe, because they are wary of the USA.

*

How do you propose to give the ECB the same powers as a normal central bank?

There is no reason why things could not be explained clearly, and referenda be conducted within weeks in France and Germany. alternatively, France could proceed speedily, as the representative French system, with its National Assembly, Senate, Presidency and Constitutional Court, should be able to pass something within weeks.

*

Why should France and Germany take all the decisions?

Because nobody else does, and because they foot most of the bill. In the end, it ought not to matter to the French and Germans what others are whining about when their economic destiny is at stake. The USA certainly does not take into account others’ whining in deciding its own internal economic policy. Nor does Russia, China, India, Brazil, or, for that matter, Argentina. Argentina defaulted, a decade or so ago, and its economy is doing great.

*

Is not default an injustice?

Being unjust to an injustice is not unjust. The exponential nature of the debt incurred, say by european countries, at the mercy of what highly leveraged speculators, such as Mr. Corzine, ex-CEO of Goldman Sachs, ex-governor of New Jersey, that is, Krugman, makes it the definition of Odious Debt.

If we do not stop the debt speculators now, we will have a feudal order within ten years.

*

Are you not happy that the Franco-German accord on Greece provided a default of 50% as you insisted ought to be done?

Yes and no. If French and German taxpayers are going to reimburse the banks for said default without nationalizing them and acquiring control, one will have transferred an intolerable burden on the Greeks into an intolerable burden on French and German taxpayers, and their economies (as austerity will cause a recession).

*

What else do you propose?

A worldwide limit on leverage, and that means limit on the Fractional Reserve System. A worldwide Financial Transaction Tax on all transactions. The outlawing of most derivatives. Outlawing of Credit Default Swaps. Right now the Swap market uses 100 times leverage, allowing speculators to sink countries. Next, they will be capable of volatilizing planets, like in Star Wars, and our politicians would say it’s OK, they read it in the Financial Times first (as Obama crows). It’s may be wiser to put an end to their evil empire now.

Outlawing of any trade and organizations threatening nations’ economies. Differential treatments on derivatives between commercial operators (provided with insurance) and speculators (providing liquidity). The outlawing of all banks too big to fail, using anti-monopoly and security laws (Britain evoked anti-terrorist law against Iceland, for financial terrorism, so there is a precedent!)

Last and not least, criminal prosecutions of one the greatest criminal organization ever, the present worldwide plutocracy. Not to forget forced regurgitations of ill acquired gains. And president Einsenhower tax of 90% on the great fortunes.

*

What do you think about the synchronized worldwide crackdown on the Outraged, Indignes, Occupy Wall Street movement?

Well, ever since the worldwide crackdown on Wikileaks finances, we know that the plutocracy will do whatever it takes. Just contemplate Auschwitz. Plutocracy brought that too, and did whatever it took to conduct its business for its best. Many who are powerful nowadays descend from those who financed, organized, instigated or collaborated with individuals or organizations which facilitated, or constituted various aspects of fascism. American soldiers fighting on the beaches in Normandy, would not have believed that they were shooting at forces that American plutocrats made possible.

*

So why do people accuse the euro and the European Union so much?

There are a lot of euro haters out there, and a lot of individuals, and governments looking for scapegoats. The rise of Europe steals power from others, such as Wall Street plutocracy. When Krugman howls against the euro, he howls for Wall Street, which, however indirectly, feeds him and his nationalist fiber. without Wall Street, new York would not amount to much (who would pay the 35,000 police force?) Krugman was telling on his blog recently how New York was the “world’s greatest city“. Making Wall Street, I guess, the world’s greatest street. Is an economist in love with Wall Street still an economist? Are those whose ‘breath is taken‘ by New York still fully human?

*

Where does the obsession with Europe come from?

The negative obsession comes from the plutocracy, and it is, to a great extent, 17 centuries old. The Franks were antagonistic to the system of the Late Roman empire, which was anti-democratic, fascist, plutocratic and theocratic. Their rule was much less of all the preceding, to the point that the Franks refused to create a durable European superstate (on the ground of equality). Half a millennium later, Muslim jihad, and various invasions from Mongols and Vikings, forced the creation of a military caste, the Frankish aristocracy, though.

“Europe” is an attempt to reconstitute the ancient Imperium Francorum, when France and Germany were the same polity. Various attempts in the past were too muscular, or poorly thought out. Whereas Francia and the Holly Roman Empire (Imperium Romanum Sacrum) were rarely in conflict in the middle Ages, complicated conflicts have become quasi permanent since the Sixteenth Century. It is time to put an end to them.

Interestingly the conflict with Francia started with Parisian haughtiness, nothing deeper than that. So West Francia and East Francia grew estranged, as the centuries flowed by. After Louis XIV, Frederick the Great, Napoleon, Bismarck, Napoleon III, Prussian fascism and Hitler, the French and German people have realized that they were victims of an horrendous crime in July 1914 (when French and German socialists scrambled to organize a general strike rather than let the fascists unleash war; unfortunately they failed).

*

So the European project is perfect according to you?

No. The present crisis shows clearly that the federalization of Europe has to be cranked up a lot. Needed federal structures need to be erected. The European Central Bank needs to become a central bank with full prerogatives, same as those of the US Fed. European statistic and fiscality have to be improved considerably.

The lesson of the growing enmity between Western and Eastern Franks, 1,000 years ago, is that indifference is not an option, and that acting locally without thinking globally is not an option either. “Imperium” is not a dirty word. Quite the opposite. The Romans were right on that. And, originally, the Franks, for centuries, viewed themselves as another, improved, phase of Rome. And they were right.

*

Can you give a more philosophical perspective?

In democracy, people rule. in plutocracy wealth, and accompanying characteristics of Pluto, rule. The money creation system cannot be left to Pluto, but ought to be the prerogative of the People. Indeed, money represents power, and power rules. If all the money and power if left to the wealthiest, there is no more democracy, de facto. Hence the banking system has to become anti-plutocratic.

That means, first that invisibility, one of the Dark Lord’s characteristics, ought to be taken from Pluto. Hence all financial transactions ought to be declared, and Shadow Banking ought to be outlawed.

All of banking ought to be remade under transparent democratic watch.

Instead what we see is Goldman Sachs partners ruling the world, more than ever. And not just the White House. The new head of the ECB and the new Italian PM were, or are (!) Goldman Sachs principals (so called “associates”). Goldman Sachs systematically recruits people at the heart of power (central bankers, EU commissioners. The new head of the ECB was in charge at Goldman Sachs of selling to Southern Europe a “product” to dissimulate debt to Eurostat.)

*

What is going to happen?

It depends how well informed and thoroughly angry People get, in a timely manner.

Plutocracy is the most frequent and most important cause of civilizational collapse. It generally prevents to solve lethal ecological problems (see the Mayas). This is happening today. For example the craze for fracking and extremely deep sub-oceanic oil is a distraction, as the greatest ecological catastrophe in 65 million years unfolds. “As each year passes without clear signals to drive investment in clean energy, the “lock-in” of high-carbon infrastructure is making it harder and more expensive to meet our energy security and climate goals,” warns Fatih Birol, International Energy Agency Chief Economist. By 2020, every currency unit economized by not investing in clean energy, will cost 4.5 times more to society in ecological damage.

The plutocrats love war, because war is Pluto’s celebration by all, united in mayhem. Not developing an energy and ecology plan will certainly bring war (fracked water, or a fracked quake, may get you first).

In 1914, the plutocrats were hiding behind the (plotting Prussian) fascists, and they were not stopped. Nor were they stopped in the 1920s and 1930s. France and Britain had to unleash a terrible war in September 1939 against Hitler (and Stalin, and American plutocracy!) This time, we stand forewarned, and it’s going to get worse.

The naïve Pinker, a psychologist at the propaganda outfit Harvard, just wrote a book, the “Better Angels Of Our Nature” (he lifted the sentence from Lincoln’s Inaugural Address, March 4, 1861). Pinker argues that we are better, and smarter than ever. However, Pinker is the victim of an illusion. What is going on out there is an unsustainable bubble. Including an unsustainable bubble of population (population augmented by 5 billion in less than a century!) In other words, we are on the verge of an incomparable crash. The sort of crash the Dark Side of Homo is made for. Pigs rule, slaughter comes, biosphere gets re-established.

***

Patrice Ayme

Share this: Please do share, ideas are made to spread and enlighten!